Table of Content

From digital wallets to neural networks, the FinTech industry has risen with speed while delivering innovative solutions. Digital wallets created the ground for mobile payments, leading to open banking, blockchain, smart contracts, cybersecurity, neural networks, and much more.

With AI in FinTech, every development and innovation comes with an unprecedented security level due to the nature of information these solutions access and transmit. Artificial intelligence (AI) plays a pivotal role in shaping the tools and solutions at every level. The complex AI-based algorithms and neural networks are helping to fine-tune the decision-making process.

Let’s understand the FinTech revolution driven by AI and helping the industry steam ahead.

The Rise of Digital Wallets

The first digital payment system was introduced by Coca-Cola in 1997. However, the first digital wallet system in the banking sector came in the 1980s in the form of DigiCash and Millicent.

The 1990s brought Mondex, and in the 2000s, Nokia Mobile Wallet and Google Checkout were introduced. Today, we have Apple Pay, Venmo, and even crypto digital wallets.

The earlier digital wallets ran on proprietary integrations with payment processors, which were largely closed-source. In the 2000s, payment gateways went through integrations with networks like Visa and Mastercard. The modern-day technical architecture for digital wallets is improved with microservices, real-time processing, AI, and machine learning technologies.

With digital wallets, the banking sector has become more streamlined and productive. From standing in lines to deposit, withdraw, and transfer money, we can process these transactions within seconds from a smartphone.

The added convenience and accessibility have led to a substantial decrease in cash utilization. More than a quarter of payments in the UK have gone contactless, and 53% of Americans use digital wallets, with PayPal taking the highest share of all.

As digital wallets streamline transactions, advanced technologies like encryption and two-factor authentication are ensuring the utmost security. Improvements in user convenience and accessibility have paved the way for financial inclusion for anyone with an NFC-enabled smartphone to accept or make payments through digital wallets.

Overall, digital wallets have improved the banking experience and are helping build a cashless society.

Leading FinTech Software Development Company

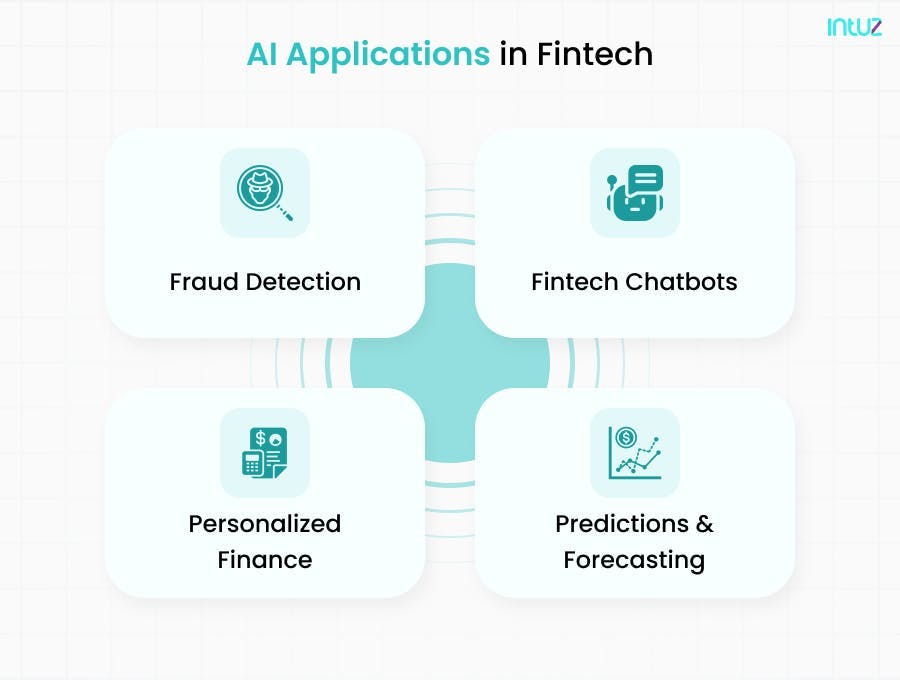

Explore NowTop 4 AI Applications in FinTech

The integration of artificial intelligence in FinTech has led to several innovations. Overall, FinTech has become customer-centric and secure. AI is helping FinTech companies improve customer experience and make their internal operations productive and streamlined.

The tedious data entry tasks in the FinTech industry have improved by 80%. Moreover, it can potentially increase the industry revenue by 34% if utilized correctly. Here are a few functions of AI in FinTech;

1. Fraud Detection

AI can detect bank fraud through AI’s analytical power to identify suspicious user behavior and transactions. AI can effectively monitor user behavior and their actions, especially those that are deviating from a set or expected course of action.

2. Personalized Finance

With AI, FinTech companies already provide personalized recommendations to their users for better financial security. Banks use AI to provide instant personalized customer support, leading to better engagement. AI systems analyze customer data to understand their behavior and preferences, creating a pool of shareable suggestions with the customers.

3. Chatbots

Customer service FinTech chatbots with personalization systems have become a common occurrence. Banking applications are integrated with these chatbots to provide instant support and answers to customers. These chatbots also harness natural language processing technologies to converse with the customers, humanizing the service.

4. Predictions and Forecasting

For FinTech companies, AI-powered forecasts and predictions mean they can make better decisions. Since AI can provide more accurate predictions than traditional predictive models, FinTech companies can implement effective risk management strategies and gain from improved portfolio performance.

Better predictions, effective analysis, risk management, trends analysis, and other capabilities combine together to help investors make better investment decisions and strategies.

We have several examples of AI implementation in FinTech;

PayPal is using machine learning algorithms and AI for fraud detection in real-time to protect its customers and merchants.

Zestfinance uses AI capabilities for credit risk assessment and establishes a customer’s creditworthiness.

Betterment is a FinTech service provider using AI to assess investors and suggest optimized investment strategies. It also accounts for individual risk profiles to provide guidance.

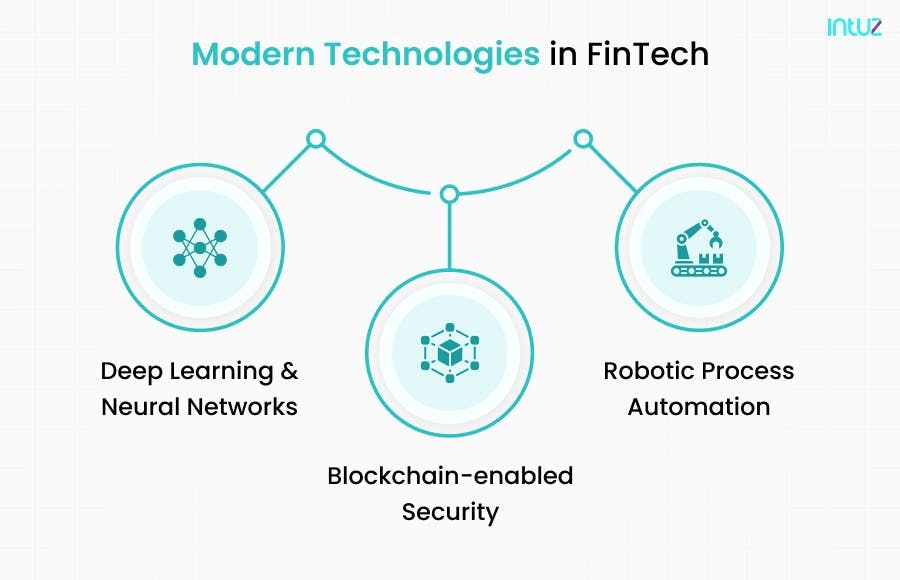

Modern Technologies in FinTech

The earlier AI applications driven by ML technology used primitive algorithms. These include logistic regression, decision trees, and support vector machines (SVMs). These algorithms are currently employed for fraud detection, churn prediction, and customer credit risk analysis.

The integration of neural networks into the ecosystem is led by the need to assess and analyze unstructured and non-linear financial data. So, now the FinTech companies are not only processing alphanumeric data, they are also assessing images, video, and audio data.

Let's take an overview of how progressive technologies have helped shape the FinTech industry;

> Blockchain-Enabled Security

With blockchain integrated into the FinTech sector, organizations benefit from higher security. Smart contracts added an extra layer of security and gave way to self-executed contracts.

> Robotic Process Automation

It automates repetitive tasks based on pre-set rules and conditions. RPA has helped reduce operational costs for FinTech organizations and improve efficiency. RPA is successfully handling back-office operations and compliances for FinTech companies.

> Deep Learning and Neural Networks

CNNs can effectively analyze market trends and insights. It allows investors and financial institutions to make informed decisions. Specifically, they can assess risks in trading by analyzing historical stock trade prices, patterns, and trends to help users make informed decisions.

Inspired by the structure of the human brain, these neural networks composed of deep learning architectures can learn and adapt through the data it processes. These networks can handle non-linear and complex relationships between unstructured data.

Image and audio analysis algorithms are run on convolutional neural networks (CNNs). CNN is also used in smartphones for face recognition, and now it is employed by FinTech companies.

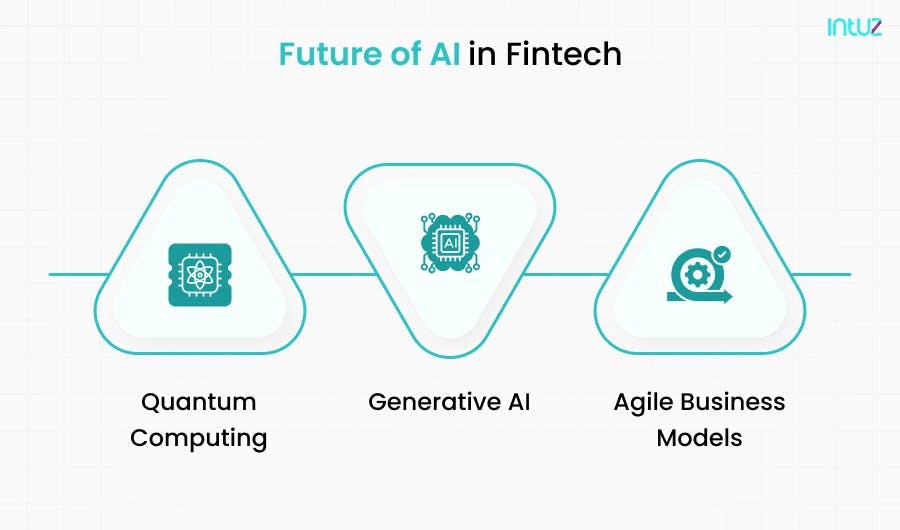

The Future of AI in FinTech

As we step into the future, the implementation of AI and related technologies has the potential to add more use cases and improve the existing applications. So, the existing applications of AI in FinTech, like fraud detection, risk management, customer analysis, trend analysis, etc., will become better, more precise, and more accurate.

We can see more branches of FinTech emerging in the future, like InsurTech, RegTech, etc. Each of these spin-offs will have industry-specific benefits and applications. As these sectors will improve, so will the customer experience.

Automation is going to become a natural occurrence in every FinTech, RegTech, and InsurTech company. As a result, the companies will experience better productivity, higher profit margins, and the capability to innovate.

Among the potential advancements of AI in FinTech, we can include;

A. Generative AI

Generative AI presents fintech-specific ways of providing customized analytical solutions. As AI in fintech mimics human-like speech and sentiment analysis, it translates to better fraud detection.

Generative AI excels at assessing complex data and patterns that are unique to financial transactions. It also helps emulate the complexity and inter webbed transactions of the financial industry to train AI models for better results.

B. Quantum Computing

Quantum computers can perform complex computations on a larger scale than traditional computers. Leveraging quantum principles, we will see AI systems in the future that vigorously check for fraud detection through inherent parallelism and probability amplitude techniques.

Although at its nascent stage, Quantum computing is helping FinTech companies with faster calculations. Quantum computing algorithms employed in FinTech include the Quantum Monte Carlo Method, Quantum Machine Learning Algos, Quantum Fourier Transform, and others.

Quantum computing can outperform classical computers. However, their real-world applications are still under development. We can expect further advancements in this field in the near future.

C. Transformation of Business Models

AI has the capability to improve routine and complex analytics. FinTech companies can work on adaptive, proactive, and evolving business models as AI-driven solutions go deeper into understanding customers, markets, and trends.

As a result, they will be able to remain relevant to their audiences and continuously provide ways to enhance customer value propositions. This leads to better revenue and sales.

Going forward, AI will become a strategic partner for FinTech companies, making them more customer-centric and agile than before.

Will the Human Touch Completely Vanish from FinTech Due to AI?

Today, we have FinTech chatbots servicing the customers, providing instant support as and when needed. At present, AI in FinTech is still growing amidst practical tests, analysis, and experimentation.

However, whether AI will take over depends on how much responsibility we want AI to have in the future. With privacy and data leakage debates still ongoing, we can expect the future AI to be human-regulated.

A Leading AI Development Services Company

Discover AIConclusion

AI in FinTech is creating new pathways for companies to build and deploy better solutions than before. While the companies are enhancing their security with FinTech’s assistance, they are providing better customer solutions. Effective AI-based trend analysis allows personalizing customer services, where FinTech chatbots are improving customer experience through instant assistance.

FinTech AI will become more important in the future. Intuz excels in FinTech app development with a comprehensive understanding of AI technology. We deliver AI-enabled future-ready FinTech applications and solutions. Get in touch.