Table of Content

Remember the days when AP departments were still mostly paper-based? Vendor invoices would arrive in the mail, prompting an AP staff member to:

- Manually enter the purchase orders in a register

- Circle back with the department that initiated the purchase to verify that the product or service had been satisfactorily delivered

- Get a CFO or controller to sign a check

After doing due diligence, the AP staff member would send out the check via the postal service. Even in the age of digitization, 54% of global AP teams remain only partially automated, spending over 10 hours per week on manually processing invoices and supplier payments.

Not exactly a model of efficiency! No wonder accounting firms are gradually embracing accounts payable workflow automation to eliminate errors, exceptions, and rework that come with inconsistent or mismatched record-keeping.

And they’re leveraging low-cost or no-cost (LCNC) tools, such as Make.com, for that.

At Intuz, we’ve helped firms like yours successfully integrate email, shared drives, accounting systems (e.g., QuickBooks, Xero, Sage), Enterprise Resource Planning (ERP) platforms, and more into visual workflows for streamlined invoice processes, approvals, and payment tracking.

So if you’re also thinking of automating the AP function, you’re on the right path. This article explores four high-impact accounts payable tasks you can automate, particularly using Make.com. The best part? You’ll also receive implementation best practices from our experts.

Top 15 AI Software Development Companies in USA

Explore Now4 Critical Accounts Payable (AP) Workflows to Automate

1. Automated invoice data extraction and entry

Did you know that the average invoice takes 10.1 days to process, for $9.87 per invoice? Automation can reduce both by more than 60% on average. Well, that’s a win, as manual invoice data entry is a common choke point in AP and as we’ve seen, not the best use of time!

Now what if there were a workflow that could capture incoming invoices and transfer the data directly into your accounting system? It’s possible with Make.com. It allows you to monitor a shared folder (like Google Drive or Dropbox) or a dedicated AP inbox.

As new files (or invoices) arrive, the LCNC tool uses OCR software, such as Google Cloud Vision, Docparser, or Nanonets, to extract the following key fields:

- Invoice number

- Vendor name

- Dates

- Line items

- Totals

Once extracted, the data is logged into your accounting tool. The result? Faster invoice handling with fewer entry errors.

Intuz Pro Tip

To ensure clean data capture, we suggest standardizing your invoice intake. A good approach is to set up a single email alias (such as invoices@yourfirm.com) or create an upload folder with naming conventions organized by vendor or department.

Also Read: AI-powered Fraud Detection and Credit Scoring in Finance

2. Purchase order and invoice validation

Validating against purchase orders is a crucial step in preventing payment errors. However, when your team must manually retrieve records and cross-check them line by line, the process becomes daunting, especially when working with disconnected tools.

Make.com enables you to create a validation workflow that compares invoice data with existing purchase orders, utilizing logic you define.

For example, when an invoice arrives via email or upload, Make.com extracts the PO number, vendor name, and line items using connected OCR tools or parsing apps. It then retrieves the corresponding PO data from your accounting system and checks for a match.

If the values align, the invoice moves to the next step in your workflow. If they don’t for whatever reason, item quantity differences, line total variances, or missing references, Make.com flags the discrepancy, such as and triggers a review action.

Intuz Pro Tip:

We recommend creating a lookup table that links approved vendors with their expected PO number formats and issuing departments. This acts as a secondary check to catch mismatches that might pass through basic field matching.

3. Automated invoice approval

Approval delays are one of the most common reasons for late payments in AP. Chasing approvers by email is tedious and adds unnecessary strain to vendor relationships.

With Make.com, you can create conditional approval flows that automatically route invoices to the right people. For example, you can define rules that send invoices above a specific value to senior managers or route vendor-specific invoices to a designated department.

Make.com reads the invoice fields, matches them against your approval logic, and sends them to the appropriate person via Slack, Microsoft Teams, email, or any other tool of your choice.

Additionally, you can set up timed reminders. If an approver hasn’t responded within two days, Make.com can send a follow-up or escalate the matter to the next approver in the chain. This reduces bottlenecks and ensures things keep moving along.

Intuz Pro Tip:

Vendor onboarding often gets overlooked as a process. Missing tax documents, incomplete bank details, or unverified records can stall payments and introduce compliance risks. What we suggest is designing a two-part vendor onboarding flow.

- First, set up a structured intake form with dropdowns, validation rules, and required document uploads to ensure consistent entries.

- Next, integrate document verification APIs, such as EIN validation for US vendors or ACH routing number checks for bank details, verifying information in real time before it enters your system.

Make.com connects these services in the background and flags incomplete or invalid submissions.

Sample Approval Logic Table for Automating Invoice Approvals

| Invoice Amount Range | Department | Approver Role | Response Time (SLA) | Escalation Rule |

|---|---|---|---|---|

| $0 – $1,000 | Any | Department Manager | 2 business days | Escalate to Finance Lead |

| $1,001 – $10,000 | Any | Department Head | 3 business days | Escalate to CFO |

| $10,001+ | Any | CFO | 2 business days | Escalate to Partner or Director |

| Any amount | Vendor = High Risk | CFO + Compliance Officer | 1 business day | Escalate to Risk Committee |

4. Payment scheduling and processing

Once an invoice is approved, the next challenge is to ensure it gets paid. Make.com enables you to set up a workflow that automatically schedules payments, eliminating the need for manual reminders, calendar alerts, and batch exports from the process.

You can define rules by due date, payment terms, or vendor priority. For example, Make.com can trigger a payment request three days before the due date, send it to your banking app or payment gateway, and log the transaction in your accounting software.

You can also add checks to avoid duplicate payments or process payments only on specific days of the week. If you’re managing multiple clients or departments, Make.com lets you split workflows by cost center.

Automating this stage ensures more predictable disbursements and fewer avoidable issues. According to PYMNTS, 88% of business leaders report that they benefit from faster payments, keeping their balance sheets healthy and vendor relationships strong.

Intuz Pro Tip:

We can set up a delay module in Make.com that holds payment execution until a due date is reached or flag invoices with mismatched bank details for review. This adds a layer of control to the automated process.

How Intuz Can Help Implement Accounts Payable Workflow Automation with Make.com

By now, you have a clear picture of what’s possible with accounts payable workflow automation and how you can go about it on Make.com. But to be honest, you can’t just drag a few modules onto the LCNC tool canvas and expect to build automations that stick forever.

What you need is a robust partner like Intuz that can guide you through the process with no extra complexity. Here’s how we approach AP workflow automation for our clients:

1. Identify and prioritize repetitive AP tasks to map out the workflow

We begin every engagement by helping you assess the most repetitive accounts payable tasks that drain your resources, are high-volume, and prone to human error—for instance, entering invoice details manually into Xero or cross-referencing a PO in a shared spreadsheet.

Next, we sketch out the whole AP workflow, breaking it down by stages:

- How invoices are received: (e.g., email, upload portal, physical mail)

- Where documents live: (e.g., Google Drive, Excel, ERP)

- How approvals happen: (e.g., email chains, Slack messages, printed signatures)

For each step, we also ask:

- Who’s responsible?

- What tools are involved?

- When do delays or errors commonly happen?

This exercise helps us identify the parts of your AP process that are ripe for automation.

2. Choose and connect your core apps

Make.com works best when it’s integrated cleanly with the tools your team already uses. Intuz experts help you select the right apps for automation, including:

- Banking: Wise, Stripe, PayPal

- Accounting: QuickBooks, Xero

- File Storage: Google Drive, Dropbox

- Spreadsheets: Google Sheets, Excel

- Communication: Gmail, Outlook, Slack

- ERP or Finance Systems: NetSuite, SAP, Zoho

We’ll also assess whether your current stack needs adjustment. For example, if you’re managing vendors in spreadsheets, we’ll help you shift to a structured database like Airtable with defined field types.

3. Build automated scenarios with error-handling

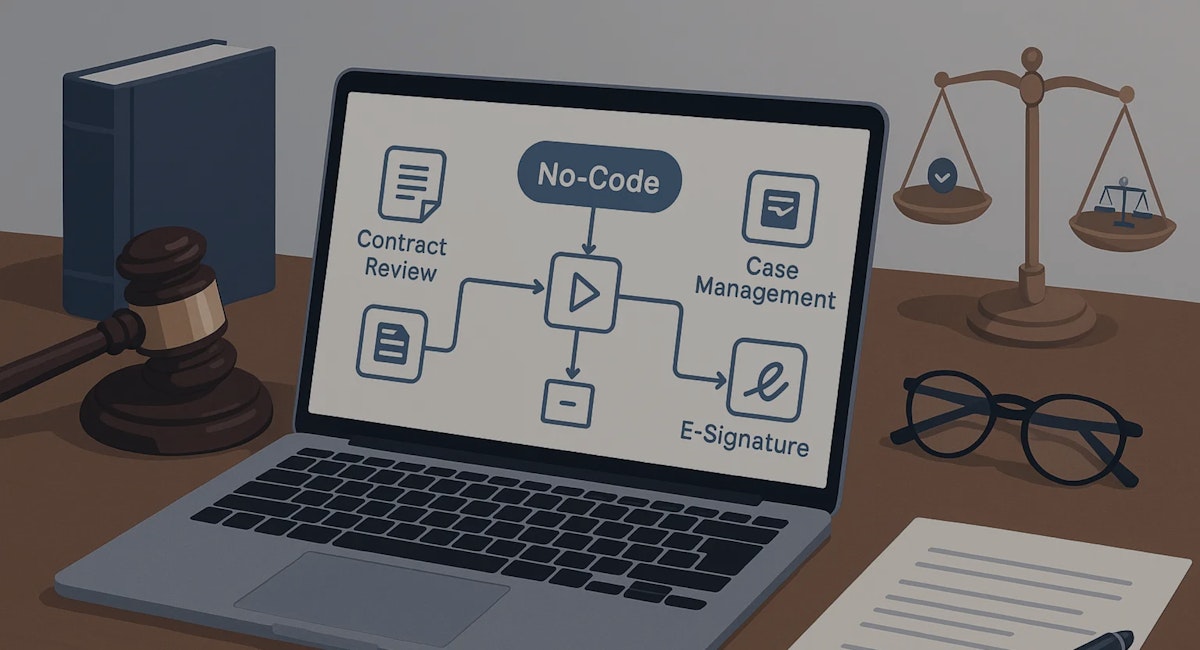

Once the app environment is decided, we’ll use Make.com’s drag-and-drop visual builder to connect them, enabling data to flow automatically from one step to another. Every automated workflow (called a scenario) is built with clear logic, fallback paths, and audit checkpoints.

For example, we can create a scenario where an invoice received via Gmail is automatically parsed using OCR, logged into a Google Sheet, and then sent to Xero as a draft bill. Or a workflow could look something like this:

Whatever the scenario, each one starts with a trigger, such as a newly approved vendor form or a scheduled weekly batch run, followed by a series of actions, including checking for duplicate invoices, updating a payment tracker, or notifying the finance team for review.

In addition, we can add error-handling logic into every scenario, so if something fails (a disconnected app, duplicate entries, or a failed API response), Make.com alerts the right stakeholder immediately without halting the entire process.

4. Test with real data and use cases, deploy, and iterate

Once everything is ready, it’s time to test the automations, and we prefer doing that against actual edge cases and operational scenarios, like:

- High-value invoices that trigger multi-level approvals

- Vendor records with missing or inconsistent data

- Out-of-cycle payment requests

We’ll involve your key team members from finance, procurement, or IT to review the results and confirm that the workflows execute exactly as intended. We’ll also track success and failure rates, process times, and error frequencies through Make.com’s dashboards and logs.

Once testing is complete, we go live. But our job doesn’t end here.

We’ll continue to monitor and optimize the accounts payable workflow automations to ensure everything’s tip top and aligned with your team’s processes and reporting needs.

If you’re keen to explore your best automation opportunities, book a free consultation with us and let’s review our current AP process to see where we can make an impact.

About the Author

Kamal Rupareliya

Co-Founder

Based out of USA, Kamal has 20+ years of experience in the software development industry with a strong track record in product development consulting for Fortune 500 Enterprise clients and Startups in the field of AI, IoT, Web & Mobile Apps, Cloud and more. Kamal overseas the product conceptualization, roadmap and overall strategy based on his experience in USA and Indian market.