Table of Content

The concept of using intangible assets besides currency notes and stock certificates is not lost in the financial services industry. From the usual licenses, trademarks, and patents to cryptocurrencies, the sector has worked with assets with identifiable value and lifespan.

So all that talk about the Internet of Things or IoT - a suite of technologies and apps that connect and exchange data with other systems and devices over the internet or other communications networks - does not seem irrelevant in the economic context.

Besides analyzing the clients' physical assets properly, the IoT ecosystem makes it easier and more efficient for companies in the finance industry to digitize operations. A major tech advancement involves using IoT to improve service delivery and customer experience.

IoT supports data transmission over a range of digital devices that connect over the internet. These connected devices exchange data via Bluetooth, WiFi, or a USB cable. The IoT technology is helping banks and fintech firms capture and study data as accurately as possible.

IoT has given a new meaning to data science as it can be used for tapping into new markets while also improving customer service levels. There is an increased focus of banks on improving financial services through the real-time data flow.

It is expected to boost the use of IoT in the finance sector. Research shows the global IoT in the BFSI market is predicted to reach $2,030 million by 2023. It is estimated to grow at a CAGR of 52.1%, considering it was only $249.4 million in 2018. That is a huge jump!

What is IoT in financial and banking services?

IoT in financial and banking services presents interconnected IoT devices and their seamless integration with other web platforms. This network ensures the secure and accurate processing of data in an on-premise and cloud server. It helps finance advisors improve customer experience and streamline operations.

IoT connects different tools, devices, and software that finance companies use. It supports improving your service delivery and operational workflow through

- Smart ATMs

- IoT-enabled ATMs

- Movile-based Point-of-Sales systems

- Wearable devices

- Mobile banking applications

The technology collects and processes the data to help the finance team make better decisions on risk analysis, investments, insurance amounts, and more. It automates the core finance processes that boost productivity.

How IoT impacts the financial industry

Applications such as smart commercial real estate building management systems, where sensors within commercial buildings manage energy usage and environmental comfort, and auto-insurance telematics, which increase the accuracy of underwriting automobile collision policies, clearly show how IoT has improved processes.

Here are a few other ways how IoT is influencing the financial sector:

- IoT enables financial organizations to deliver better services to their customers as analyzing their critical data helps them understand their needs and suggest personalized products as per their preferences.

- Banks and financial institutions can use data gathered by IoT devices to offer usage-based differentiated offerings. For instance, Usage-Based Insurance (UBI) or Pay As You Drive (PAYD) insurance options determine premiums based on the driving behavior of the customer or the distance traveled. The calculation is done using data gathered by telematics devices.

- IoT-powered monitoring solutions provide accurate information on the condition and performance of equipment such as ATMs, drive-up systems, night depositories, vaults, and so on. Analyzing the information gives a better understanding of the efficiency levels of the equipment and helps reduce the error resolution time.

- IoT provides real-time data that banks can use to update customers about offers that best suit their needs and speed up decision-making.

- Banks and financial institutions take the help of an IoT development company to mitigate risks, block hacked accounts, and analyze suspicious user data.

- Banking transactions have also become shades more convenient with superlative contactless payment services.

Modernize Your Financial Services with Custom IoT Solutions!

Let's Get StartedTop applications of IoT in the financial services industry

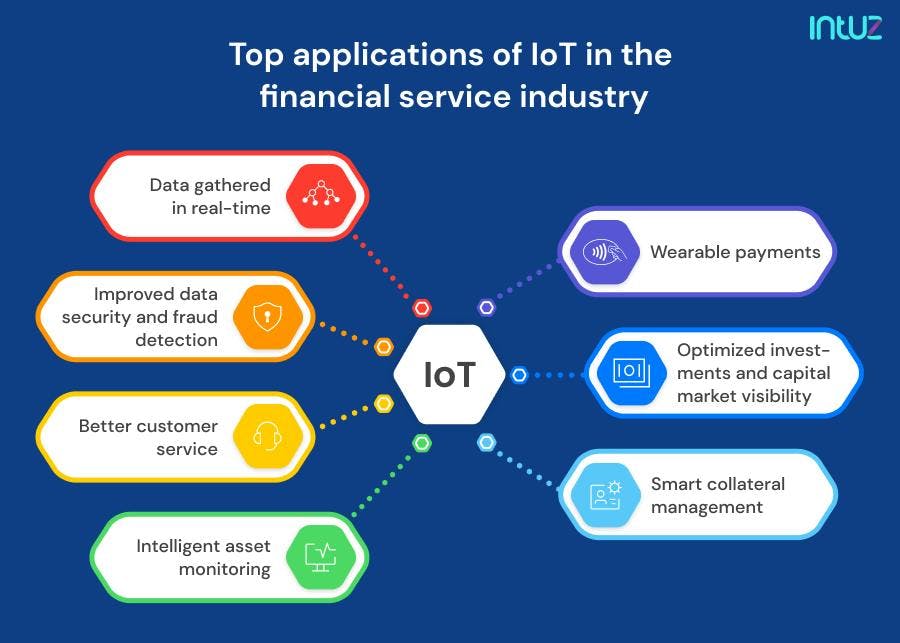

If you have read this far, you will agree that there is enough room for innovation. Even the newer BFSI startups can stand out and increase their brand visibility by deploying the technology. Here are the top apps of IoT in finance you must know about:

1. Data gathered in real-time

IoT technology has enabled data collection in real-time. Banks can use it to offer their customers additional services and update them with the necessary information, thus helping their intended audience quickly make critical financial decisions.

For instance, alerting customers when an unexpectedly high amount of money is spent on a transaction is possible because of IoT. The technology is also helpful for security purposes and builds customer trust.

Smart devices installed across a branch can monitor queues allowing customers to schedule their visits. Inside the bank branch, the data can be used to notify customers about their wait time or redirect them to a free counter.

The arrangement enhances the task management efficiency of the bank branch. On the other hand, a beacon-based system helps guide customers to the nearest branch in a new city or country, creating a sense of comfort and convenience for them.

Branches can share user data among themselves promptly to provide a quicker and personalized customer experience. Using customer data, banks can make critical decisions to save money. They can optimize branch operations and minimize the human workforce.

2. Improved data security and fraud detection

Financial companies invest heavily in IoT to improve security and prevent potential fraud. The data gathered from various scenarios are analyzed to devise a risk mitigation strategy that secures each customer account.

The accounts can then be secured through biometrics to ease payments with additional security. It helps improve the safeguarding process of data and build customer trust. IoT also prevents fraud by detecting unusual behavior in real-time.

The IoT technologies control access to customer accounts by hackers and notify customers about a fake login attempt. Analytics offer insight into how users engage with the bank website and mobile application.

The data enables them to act immediately in case of any suspicious activity and prevent fraudulent transactions before it is too late.

3. Better customer service

Excellent customer support is key to growing your business by building lasting relations with your customers. This holds true in all industries. IoT devices gather vast volumes of data that can be used to deliver better financial services throughout the customer lifecycle.

By keeping track of customer needs at different times of the year, banks can proactively send them personalized offers and reminders. The data can streamline crucial functions such as customer onboarding, support, and grievance handling.

IoT can help personalize the customer's experience by providing the bank's support team with real-time data to make informed decisions. Data analytics help employees manage client money better and develop robust and valuable reports.

The technology promotes informed decision-making to offer a seamless experience for customers, which was a bit tedious otherwise.

4. Intelligent asset monitoring

Banks and financial institutions use IoT-enabled devices to monitor their equipment. They ensure the assets at a branch are used optimally to improve its efficiency and reduce operational overheads.

They can use the data gathered by IoT devices for capacity management. For instance, the data will be helpful to identify a favorable site with maximum footfall for their ATM or branch.

It can record the performance of digital assets and offer information necessary to reduce operating costs and downtime of the branch.

Real-time data sharing across IoT networks enhances the security of a bank's assets. They can be remotely monitored and managed, mitigating risk and controlling costs.

5. Wearable payments

IoT has the potential to transform traditional banking by allowing users to access their funds from anywhere at any time. Wearables-IoT integration takes advantage of the advanced technology to offer convenient payment features.

Banks can deploy IoT devices that detect wearables within a specified range and update them with relevant news. It helps strengthen their bond with customers visiting their branch.

Collecting data from wearables will help insurance companies calculate insurance premiums based on an individual's health statistics. Wearables can also be used to make contactless payments and check account balances, thereby replacing the usage of applications.

6. Optimized investments and capital market visibility

IoT will revolutionize the tracking of market trends. Private investors and global corporations can benefit from the real-time data visibility offered by IoT-powered systems. It will help them make more informed decisions when investing their money.

The gathered data can be analyzed to build profitable trade strategies and recommend investment plans. It can also train systems and prepare them for independent trade.

7. Smart collateral management

Banks can better control their customers' assets and monitor them remotely using IoT technology. Smart collateral management is a process of managing mortgages for cars, houses, equipment, or other types of property financed through loans from the bank.

The use of sensors, for instance, can help monitor the health of a building as loan collateral. In case of any issues detected by the dampness detectors, a repair or renovation loan can be issued automatically, giving the customers a discount benefit.

Similarly, the condition of a car as loan collateral can be tracked. It can be disabled remotely in case of non-repayment of the loan amount, or expensive repairs can be automatically credited at discounted prices.

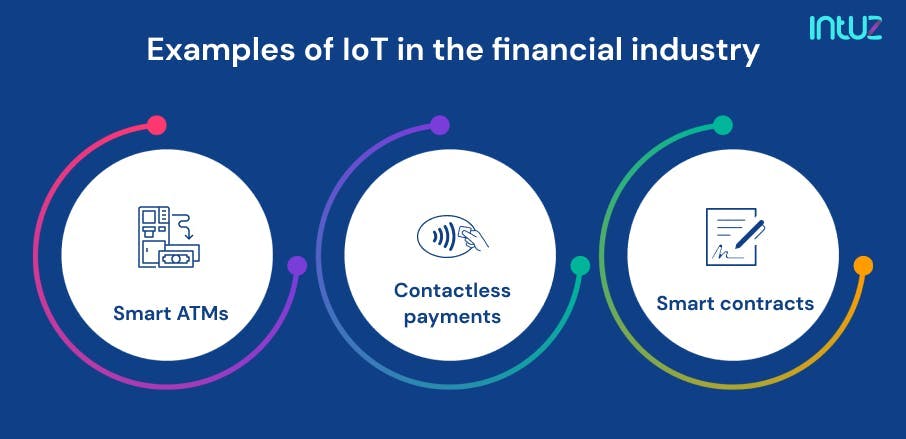

Examples of IoT in the financial industry

For organizations in the banking and financial services industry, improved operability due to the move to open banking, faster payments, and more responsive mobile services are some of the recent developments due to advancing technologies. Here are some prime examples of IoT:

1. Smart ATMs

ATMs can be made more secure and convenient by deploying IoT devices. Sensors are installed at the site to monitor critical operations such as light, temperature, and door motions.

Sensors deployed detect unusual movement on the premises while fire sensors detect fire and smoke to maintain the security factor. Custom rules can be set up to automate the ATM based on different scenarios.

Alerts are triggered in case of any abnormal conditions. Aircons, lights, alarms, and other connected devices can be controlled remotely. Customers can operate the machine through an intuitive display or even through their mobile application. IoT technology makes ATM transactions convenient and safer to use.

2. Contactless payments

Banks are enabling contactless transactions through wearable devices. Customers can use their smartwatches, smart rings, and key fobs to authenticate payments.

They can make purchases and payments using cloud-based virtual assistants like Alexa or Google Assistant. The transactions are completed simply by using voice commands.

Customers also have the power to automate the shopping process by setting up commands that automatically trigger product orders and payments.

The corresponding payment is made from the linked bank account instantly. Banks integrate instant payment solutions within their systems using open APIs to execute real-time prices.

3. Smart contracts

Running on pre-programmed terms and conditions, smart contracts are self-executable blockchain applications. They govern transactions without the intervention of humans. The use of smart contracts in banking and financial institutions enables them to streamline processes.

These contracts offer transparency in banking functions, increasing customer trust. Time-consuming tasks prone to human error or fraudulence can be bound by deploying a smart contract between the parties.

The contract will be processed only on a condition-based principle. Therefore, it allows the automation of processes. Smart contracts can process insurance claims, settlement of real-time payments, and automate the KYC process.

How to Implement IoT into your financial services

Step 1: Identify business use cases

Access your financial processes and determine areas where IoT can add more value. The most common use cases involve

- Automated compliance monitoring

- Connected sensors for high-level security

- Payment security through wearables

- IoT-enabled ATMs boost customer experience

The use cases may vary based on your unique business nature and needs. To stay competitive, build the right IoT product that meets your requirements.

Step 2: Hire the right IoT development partner

The next step will be searching for a trusted IoT solution provider who has proven experience in delivering cutting-edge IoT software to finance businesses. Check whether they know the latest trends and technologies in the finance domain.

Analyze their knowledge in varied technical, regulatory, and business areas in the context of the finance industry. It gives you confidence that they can meet your domain and technology-specific needs.

Step 3: Evaluate connectivity requirements

You need stable and scalable connectivity to run financial operations seamlessly with IoT. Based on your specific use cases, ensure you have the required bandwidth, speed, and security protocol for data transfer.

Also, consider the right mix of technologies, including low-power WAN, Wi-Fi, 5G, and more to run the various devices and systems without interruption.

Step 4: Choose the right IoT devices and sensors

While selecting the IoT devices and sensors, ensure they are aligned with your specific use cases. The highly used IoT sensors or devices for the financial industry contains

- Connected cameras - To monitor security

- Biometric sensors - To ensure authentic access to mobile app

- RFID chip - To track the different financial assets

Additionally, ensure they are compatible with your IT infrastructure and provide you with robust encryption for data protection.

Step 5: Develop or Integrate IoT Platforms

Once you are done with selecting the right mix of devices and sensors, you need to develop an IoT solution. It collects, processes, and analyzes the finance data to facilitate you with actionable insights. To build an IoT platform, you have two options

- Develop a custom solution from scratch

- Integrate a ready-to-use IoT platform (such as Google Cloud IoT, AWS IoT, Or Microsoft Azure IoT)

Go ahead with the option that supports integration with your existing systems, data analytics, and machine learning.

Step 6: Pilot the IoT Implementation

Now that you have developed a robust IoT solution, it’s time for testing and quality analysis. Pilot implementation of IoT software helps you monitor and analyze the performance of IoT services, sensors, and devices when they are working in sync.

With the help of pilot implementation, you can identify operational inefficiency, vulnerabilities in security standards, and potential bottlenecks before final deployment. You can fix them and ensure the new system works flawlessly in the client’s existing IT ecosystem and provides the expected output.

Step 7: Deploy IoT into financial services

The last step is to deploy an IoT solution in the existing IT infrastructure of the client. Ensure that all the identified user cases work as expected. Provide training to the staff and keep a close eye on solution performance. Update IoT software and hardware ongoing basis to ensure the solution aligns with changing regulatory standards and remains secure.

Adoption challenges of IoT in finance

It is pretty evident that the IoT industry is booming, and there are many benefits for banks in adopting connected technologies. However, they must also be mindful of obstacles that could arise. Some potential challenges include:

- Legacy models drive most banks, and the path to digital transformation is rough, as stakeholder buy-in is missing.

- Implementing a customized IoT strategy designed and tailored as per the bank's or financial institution's core business objectives is a challenge.

- Most organizations do not have the infrastructure to store and interpret data gathered through IoT devices properly.

- Providing cybersecurity and maintaining data privacy pose major roadblocks for banks. Customers do not readily adopt digital payments due to the lack of data security.

- Combating cybercrime is difficult for banks as fraudsters continually develop newer methods of hacking and phishing for data.

- There is no uniform standard of performance and maintenance of IoT devices. Common criteria can only be maintained if a single manufacturer provides all devices, but it is not feasible in the long run.

- Most BFSI businesses lack the technical expertise and resources to deploy IoT hardware and networks at their premises successfully.

- Sharing IoT data securely is another challenge as banks do not have the resources to share information across borders.

- There is a risk of hacking as customer data and internal information of the bank is shared over the IoT network. Data breaches may lead to regulatory and compliance issues for the organization.

What does the future hold for IoT in finance?

According to projections, there will be 41 billion IoT devices across the globe by 2027. As technology advances, the future of banking and financial services will also be centered around Big Data and IoT.

The past two decades have seen an increase in technological innovation across the IoT industry, with more robust and power-efficient hardware being used to create safer IoT networks. It has significantly impacted the operations of the sector in question as well.

IoT can address the ever-growing needs of modern consumers. Making their lives easier, the technology allows customers to check accounts, make payments, and avail banking facilities without visiting a branch or an ATM.

IoT applications allow industry leaders to reimagine processes, leading to a transformation of the finance sector. Though the industry deals majorly with intangible assets, IoT involves prominent hardware components.

Businesses leveraging connected devices and IoT networks will have enough data to redesign their operational models. Implementation of IoT technology across the banking network is projected to demonstrate considerable growth for banks and financial institutions. They can collect, store, and analyze crucial customer data. It can be used to improve current offerings and innovate better products.

Revolutionize Your Financial Services with IoT Solutions!

Explore ServicesOver to you

IoT is helping financial institutions keep up with customer expectations and stay ahead of their competitors. The technology enables them to offer personalized services to meet their customers' needs better.

IoT is changing how end-users interact with banks - from managing their finances to making transactions. It is a win-win situation for both banks and customers as innovations like IoT bridge gaps in client services while automation is easing employee workload. Banks and financial institutions can use IoT to transition from traditional processes to more productive operational methods.

Organizations can control costs and monitor performance levels at each location using data insights derived from sensors placed in bank branches and fixtures such as ATMs.

If you are looking for IoT app development in finance, look no further than Intuz. Boost your operations regarding payment processing and data safeguarding with IoT and enable transparency in your client accounts.

Book a Free 45-minute Consultation with Our IoT Experts Today! Get a customized roadmap and strategies to leverage IoT to streamline and secure financial operations.