Cloud adoption in the insurance industry is here to stay. From being cost-effective and scalable to enabling fast deployment and risk management to eliminating IT backlog and simplifying data access — the cloud offers a plethora of benefits to insurance companies. This article explores the technology in the industry along with why now is the best time to adopt the cloud.

Modern insurance buyers are more digitally driven than ever. They have access to everything from food to socks to transportation at the tip of their fingertips, on their smartphones, and they expect the same sort of service from insurance agents.

The insurance industry, however, has been slow in adapting technology to transform its traditional ecosystems. Cloud-based solutions help enable insurers to streamline their work while offering better customer experiences.

Customers and brokers can leverage the cloud to connect and collaborate on the go. Insurance companies are leveraging the features of cloud computing such as unlimited storage, low maintenance, and high levels of data security.

Migrating to the cloud allows insurance companies to:

- Achieve higher speed-to-market

- Innovate new products

- Manage risks

- Ensure business agility

- Automate processes

- Meet compliance norms

Cloud technology is revolutionizing the insurance industry by reducing costs over the past decade with structural improvements in pricing. If you look at the numbers, you would be more astonished and convinced to via this route. For instance:

- The revenue from public cloud infrastructure is forecasted to grow at a CAGR of 21% from 2018 to 2022. It is estimated to touch $411 billion by 2022.

- The adoption and spending on public cloud services are estimated to grow by 23% in 2021.

- 51% of insurers believe public cloud gives an advantage over competitors with defined success criteria.

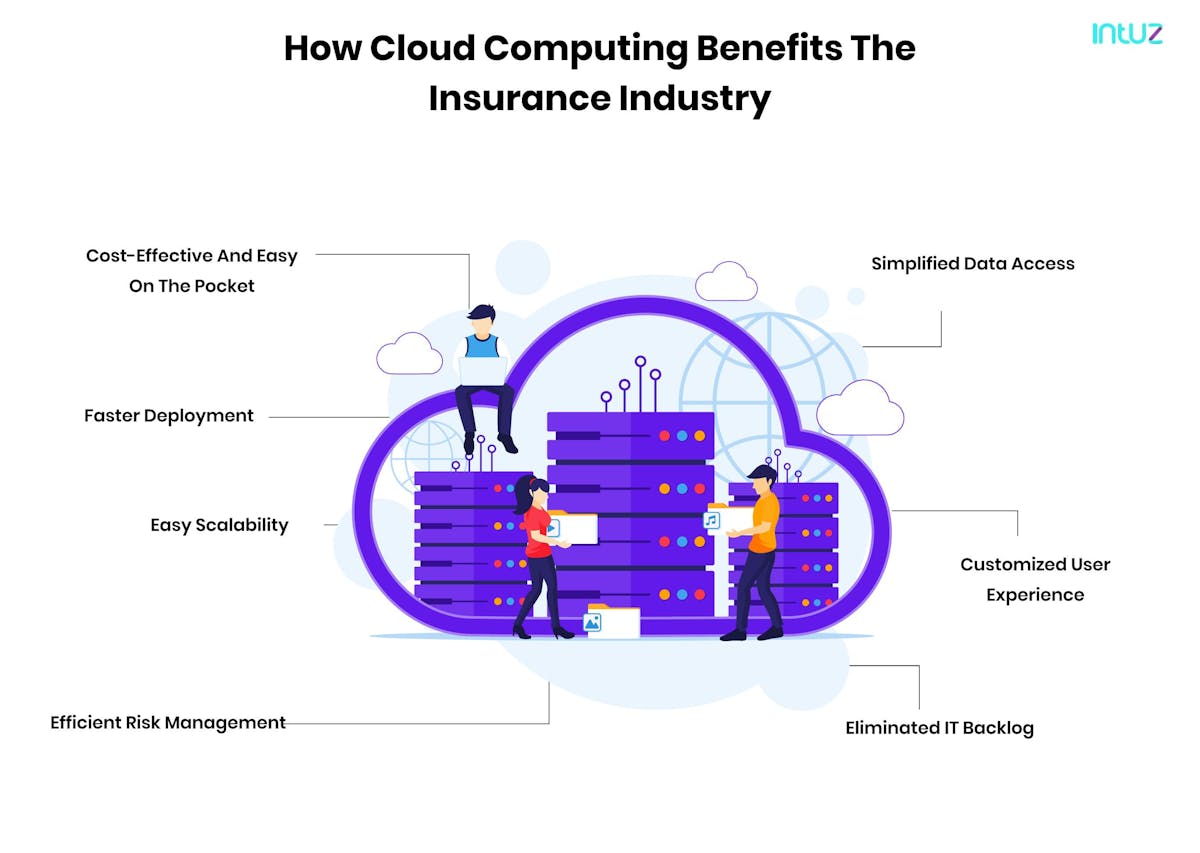

How cloud computing benefits the insurance industry

As cyberattacks have become more sophisticated and common over time, this calls for the insurance industry to adopt secure platforms to safeguard customer data. It is good to see that instead of asking “why,” they are making plans about “how” and “when” to adopt the cloud. Let us take a look at some of the top benefits of cloud adoption in the insurance industry:

1. Cost-effective and easy on the pocket

Cloud-based solutions are cost-effective compared to in-house solutions, thanks to subscription-based online solutions. You can save costs of licensing, hardware, maintenance, and installation of back-end server systems.

Automation of routine processes such as enrolment, claims management, and underwriting reduces operational costs. Custom-built pay-as-you-go plans work out really well for most insurance companies who do not want to invest massively in one go.

2. Faster deployment

Cloud-computing solutions can be deployed quickly. Insurance companies can opt for specifically tailored IT systems that bring agility to the implementation process. The shareability and scalability of cloud platforms allow multiple organizations to benefit from their infrastructure at the same time. It also cuts down on the actual expenses of the technology.

3. Easy scalability

Legacy systems do not offer the flexibility to handle spikes in demand. Though the insurance industry is stable and does not see many fluctuations, cloud systems keep companies equipped to scale as per demand. That is the beauty of this technology.

4. Efficient risk management

Cloud systems offer data security and risk management. You can protect your data against thefts with regular risk assessment and identification. Plus, if there is any suspicious activity, the system will red flag it immediately and notify your team to take appropriate action.

5. Simplified data access

Cloud-based systems offer IAM (Identity and Access Management). It provides a single sign-on facility to simplify the login procedure. Moreover, users can access critical information only within the office premises while other data is easily accessible from anywhere. You can assign access as per team roles so that the sensitive information does not fall into everyone’s hands.

6. Customized user experience

Insurance companies come up with multiple products and offerings to successfully cater to unique customer needs. For starters, cloud computing offers a more connected environment and a personalized experience for each customer.

Automated onboarding and a streamlined enrolment procedure give cloud system users an edge over traditional models. In addition, real-time verification of documents for eligibility and policy pricing simplifies the policy buying process for customers.

7. Eliminated IT backlog

Integrating cloud systems speed up the digital transformation of insurance companies. Unlike legacy systems, you do not require to migrate policyholder data from across various platforms. Therefore, there is no data loss during migration, and the process is completed in the shortest possible time. The IT team does not have to deal with any data lag.

Cloud deployment models in the insurance industry

Traditionally speaking, there are three types of cloud deployment methods — public, private and hybrid. Although the fundamental concept remains the same, every model has its advantages and purpose.

An insurance company, for instance, might not want to implement a public cloud model because they do not wish to host sensitive user data in the public sphere. Their concern is legit, which is why a privatized model works better for them.

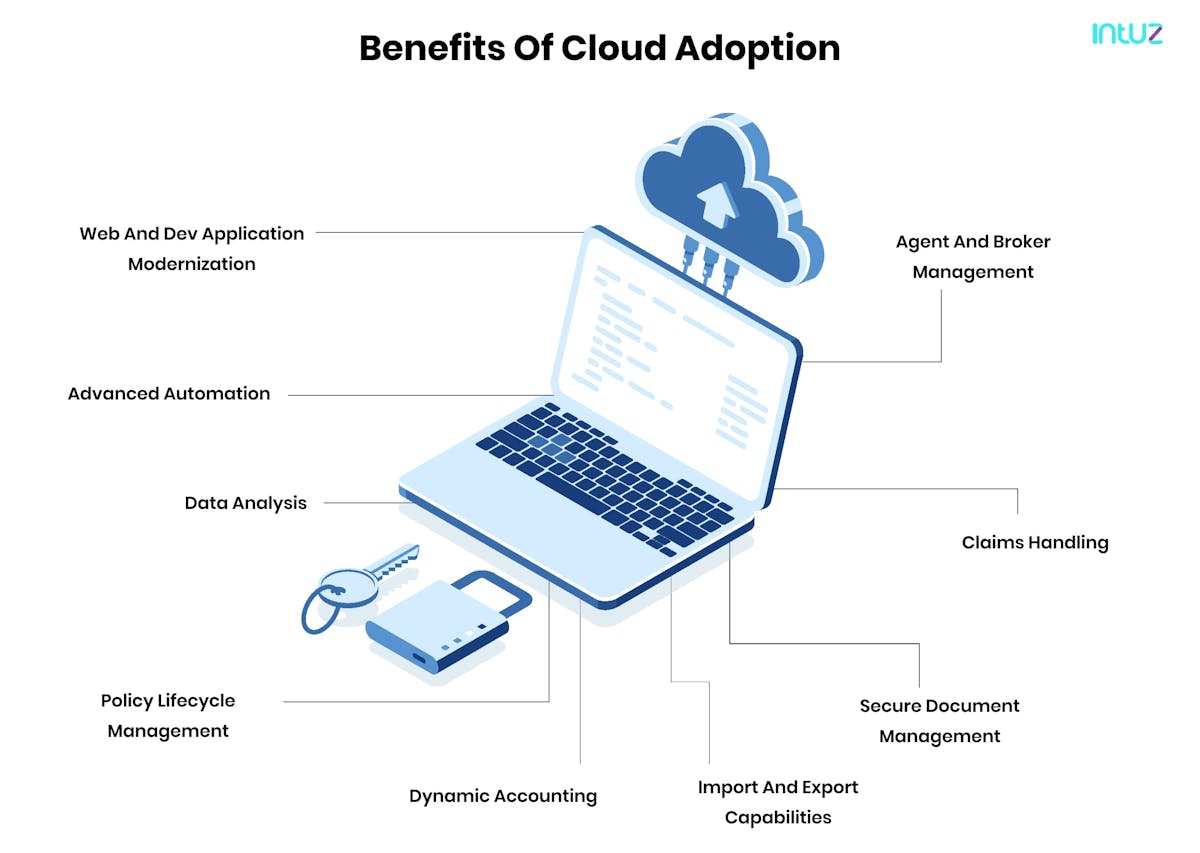

Benefits of cloud adoption:

Whatever you choose, you should be able to leverage the following features of the cloud:

1. Web and dev application modernization

The best and cost-effective option to migrate to the cloud is replacing your existing technology. Pick the most suitable SaaS platform built natively in the cloud. It relieves you of the responsibility of managing your infrastructure while having control of all the data, irrespective of the database size.

2. Advanced automation

Insurance companies can leverage advanced technologies for automation. These include RPA for rules-based automation of tasks, advanced analytics for analyzing unstructured data, and cognitive capabilities to mimic human-like decision-making.

3. Data analysis

The insurance industry collects a lot of data. Using cloud technology makes it easier to analyze and compare the data for decision-making. Statistical proofs allow insurers to launch better products and tap newer markets.

4. Policy lifecycle management

The cloud model allows the end-users to view policy details and ease decision-making quickly. On the other hand, you must set up custom workflows for different teams and products. Other essential capabilities are document generation, email tracking, logging, and auditing capabilities — all under the same roof, from the same dashboard.

5. Agent and broker management

The cloud platform must offer a centralized dashboard equipped with search facilities, bulk policy import, and FCA information capture. Another vital module is for customizing onboarding workflows that can make agent and broker management more transparent.

6. Claims handling

The platform should offer complete lifecycle management of each policyholder. Streamline your processes through a standalone claim portal and offer support for policy claims through your custom-built mobile app. The platform should also provide customizable workflows for generating reports and quick settlement facilities.

7. Secure document management

It is essential to streamline your document management as well. A GUI blocks editor with a workflow-enabled email engine and secure document storage are must-have elements for boosting efficiency. The platform should also offer digital signature integration and other user-based controls for safeguarding the customer data in question.

8. Dynamic accounting

It is an essential module for any insurance company. The accounting module must be equipped with customizable charts, dynamic reporting, and commission handling. It will help your accounts team easily manage policy deposits, ledgers and trial balances, reversal and refund, and ease the reimbursement of claims.

9. Import and export capabilities

The cloud platform must empower your teams and boost productivity with actions such as bulk import of policies and details of brokers and agents. GUI tools and self-service mapping help you offer a great customer experience.

Best practices to adopt while migrating to the cloud

A large number of enterprises view cloud adoption as not just an intelligent choice but also necessary to elevate their IT strategies. If your insurance company has decided to go via the cloud route, you must refer to the following best practices to seamlessly migrate your legacy systems to the cloud. Here are six best practices to ensure you get your cloud migration right:

- Evaluate your existing applications to identify the scope of integration. Understand the condition and life cycle of the cloud application in which you are planning to invest.

- Streamline system governance by establishing clear rules for decision-making. Your system must identify organization insiders and outsiders and allow you to assign access accordingly.

- Review rating before choosing an IT partner. Ensure they can meet SLAs. Have extensive conversations with them—book demos of all systems.

- Monitor processes to ensure both current and long-term needs are being met. It is easy to look into only the initial problems or achieving short-term goals.

- Define what you need from your cloud computing systems and how you will measure performance. Ensure the system and its results are aligned with your business needs.

- Support the change and boost acceptance of cloud computing within the organization. Conduct training and promote skill development initiatives.

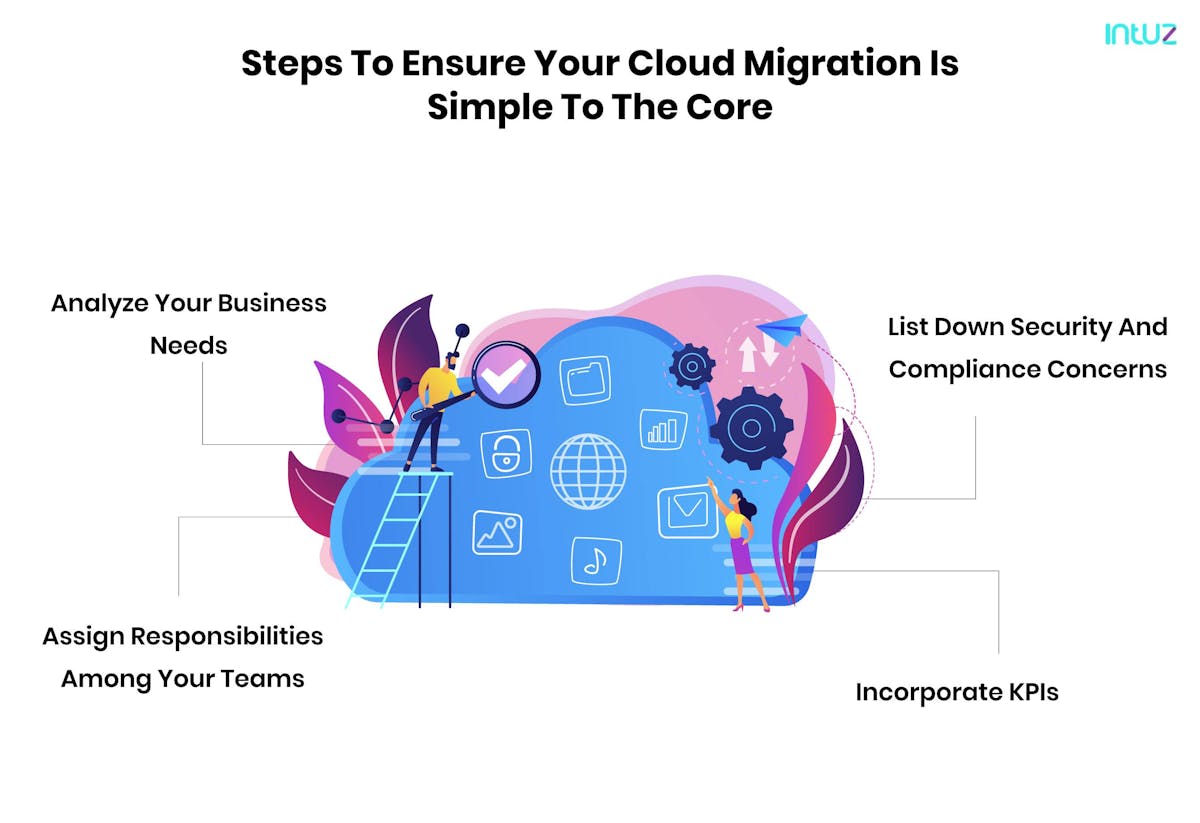

Follow the steps mentioned below to ensure your cloud migration is simple to the core:

1. Analyze your business needs

To make the most of your digital transformation and ease the navigation process, you must first analyze your business needs. Set your expectations to achieve operational efficiency and identify your pain points. Laying a strategy before deploying the new cloud technology in your insurance company will facilitate swift adoption.

2. Assign responsibilities among your teams

Define ownership of functions and delegate key responsibilities to the concerned teams. Plus, keep track of their activities and control the data they can access from the system.

3. List down security and compliance concerns

Data security and privacy regulations specific to the insurance industry must be noted down. Ensure your cloud service provider complies with the regulations. Convey to the regulatory authorities about the protocols being put in place.

4. Incorporate KPIs

Measure performance by evaluating the right metrics. Identify areas of improvement and opportunities. This information will help you leverage the new technology and accelerate migration from legacy to cloud-based systems.

Challenges of adopting the cloud technology

Ever since the pandemic began, digital transformation has boomed as an increasing number of companies moved their infrastructure online. Cloud adoption is a necessary component of that transformation. However, it is not free from its challenges.

1. Process complexity

Most insurance companies are still struggling with obsolete systems. Their management is unsure about the complexity of the technical migration, and the time it would consume. They do not have adequate support that can guide them and help them resolve their queries.

2. Already-deployed legacy solutions

Retaining customer data is essential for insurers. Even after adopting cloud systems, the company needs to manage some legacy apps to access historical information. Maintaining both methods at a time becomes a tedious task for them.

3. Performance concerns

The core functionality of cloud systems is a significant concern among insurers. It affects the decision-making process, further delaying the adoption of the services.

4. Change aversions

Insurance companies find it challenging to transform traditional governance processes. They try to avoid developing a solution or assessment tool from scratch when migrating to the cloud.

5. Security, cost, and compliance

Governance and risk controls (GRC) compliance while using cloud solutions becomes an issue. Technical challenges include rewriting app architecture and interoperability issues.

Companies can also not estimate the total cost of ownership, bandwidth expenses, and cost incurred due to latency and downtime, which further pushes them away from migrating to the cloud hassle-free and carefree.

Cloud adoption in insurance: use cases

Despite the challenges, many insurance companies have chosen to look at the positives, adopting the cloud to their advantage. Here are some popular use cases of the industry:

- Prudential Finance offers life insurance policies to HIV-positive patients now as they have proof of a longer life span of such customers. Their decision was based on the statistical evidence derived from data collected over time.

- AIA Life Malaysia asks specific profile-based questions while interacting with their customers over a digital platform. It has helped them streamline their underwriting process by completing it within an hour, saving considerable time and costs for the company.

- Ping An and Bought By Many are analyzing social media data of Chinese travelers. The company uses it to understand gaps in travel insurance products and rectify them to attract more sales and positive reviews.

- ZhongAn Online P&C Insurance is using AI-driven image recognition. It helps them mitigate claims fraud by remotely scanning phone screen images. Their AI solution accurately detects actual cracks against photoshopped ones.

What does the future hold for the cloud?

Cloud computing is the driver of digital transformation in the insurance industry. It offers higher data management flexibility compared to traditional systems. Data security against breaches and cyber thefts is higher with cloud computing.

Insurers can seamlessly transform their legacy systems by deploying cloud-based systems to satisfy emerging customer needs constantly.

Forward-thinking organizations are rapidly embracing cloud technology while budgeting for expenses on bandwidth, migration, training, and rewriting application architecture.

If you are looking to build an insurance application or software or need help migrating to the cloud, our experts can help. Simply drop us a message or call us on 1-650-451-1499.